Know more on how to stop it

Managing money today can be tough, and many people find it hard to track where it all goes. Small, unnoticed spending habits often cause money to slip through the cracks. With fintech, you can track your finances in real-time and make smarter financial decisions. It simplifies traditional financial processes, making them quicker and more convenient for you.

Whether it’s paying bills, investing, or transferring money, fintech makes it easier. This includes:

- Tracking

- Saving

- Transferring money more effectively

—without losing a penny to hidden fees.

What’s Really Going on with Exchange Rates and Remittances?

Exchange rates and sending remittances across borders are shaped by different rules and regulations. Exchange rates are driven by supply and demand for currencies, but remittance services are regulated by governments to ensure fairness and reduce fraud. In some countries with unstable economies, strict rules are in place to protect their foreign reserves and maintain currency stability.

Remittances play a crucial role in global development, serving as a vital source of income for millions of families and contributing to economic stability in many developing countries. Thus, ensuring the efficiency and transparency of these services remains a priority for policymakers and stakeholders worldwide.

Where Are People Losing Money?

When sending remittances, many people lose money due to:

- Fluctuating Exchange Rates: If the currency changes while your money is still being processed, the recipient could get less.

- Hidden Fees: Some money transfer services offer poor exchange rates or sneak in extra fees, meaning the recipient gets less than expected.

- Unclear Conversion Rates: Sometimes, how currencies are exchanged isn’t clear, leaving people shortchanged.

- Small Transfers: Sending small amounts often comes with higher fees

How Do Exchange Rates Impact Remittances?

Exchange rates directly impact on the value of the money you send. If the exchange rate weakens, the recipient gets less. For example, a weaker currency means that for the same amount of money sent, the recipient in the other country gets fewer local funds. It’s important to keep an eye on exchange rates to make sure your money goes as far as possible.

Additionally, even small fluctuations in exchange rates can result in significant differences in the amount received, especially for larger transfers. Timing your transfers during favorable exchange rates can maximize the value delivered. Moreover, some service providers charge hidden fees or apply a less favorable rate than the market rate, further affecting the amount received.

How Remittances Affect Local Economies?

Remittances can have a big effect on a country’s economy. They can help balance a country’s foreign assets and improve local labor efficiency. However, if remittance flows are poorly managed, they can lead to currency distortions, affecting everything from inflation to national economic stability. Furthermore, remittances can stimulate local economic growth as recipients spend money on goods and services, thus boosting small businesses and creating jobs.

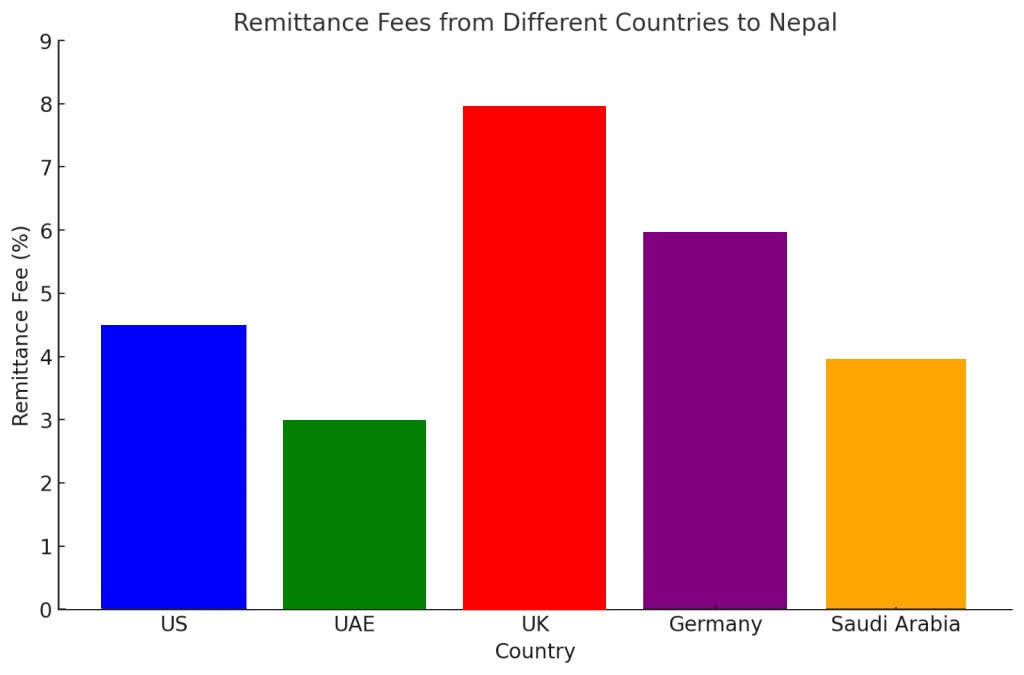

The Cost of Sending Money to Nepal

The cost of sending remittances can vary widely by country. For example:

- US to Nepal: Sending $200 costs about 4.5%.

- UAE to Nepal: Fees can be as low as 3.01%.

- UK to Nepal: Fees can go as high as 8%.

- Germany to Nepal: Costs are around 6%.

The Rise of Digital Remittances

Smartphones and mobile apps have transformed money transfers, making them faster, more affordable, and more secure than ever before. Digital platforms like IMEPAY allow for real-time global transactions with minimal fees, offering a convenient solution for regions where bank branches are scarce.

Moreover, features like instant notifications, transaction history tracking, and bill payment integrations provide users with better control and transparency over their finances. The ability to send and receive money at any time and from anywhere has also made mobile payment solutions a lifeline for migrant workers and remote communities, further bridging the gap in global financial accessibility.

Digital payment apps like IMEPAY are not just tools for convenience; they are driving forces behind a cashless economy, fostering innovation, and empowering individuals and businesses alike to participate in the global financial ecosystem.

How Can You Avoid Losing Money?

Here’s how you can make sure your money goes as far as possible:

- Compare Providers: Use online tools to compare exchange rates and fees.

- Read the Fine Print: Always check the terms to avoid surprise fees.

- Choose Transparent Providers: Look for services with upfront, clear fees and real exchange rates.

- Track Exchange Rates: Watch trends and time your transfers for the best value.

- Use Authentic Website: By choosing reliable websites like IME, you can reduce fees, ensure safe transactions, and access favorable rates for currency exchanges or money transfers.

The World Bank’s Efforts to Lower Costs

The World Bank is working to reduce remittance costs globally, aiming for fees below 3% by 2030. Central banks and governments are also improving policies to make international money transfers cheaper and more accessible. As remittances become more important to global economies, governments are increasingly regulating the sector.

Why Choose IME Remit for Your Transfers?

IME Remit is one of Nepal’s leading remittance services. With over 2 decades, IME offers:

- Fast, Secure and Reliable Transfers: Money arrives quickly, often in real time.

- Low Fees: IME Remit has the best rates, saving you more on every transfer.

- Trusted Partners: IME works with top international and local partners such as Moneygram, RIA, Kyodai Remittance, Al Ansari exchange and other partners from all over the world to ensure your money is sent securely.

With IME Remit, you can send and receive money easily, without worrying about hidden fees, and make sure your loved ones get the full value of your support.

Take control of your finances today, and make sure your hard-earned money goes further with the right remittance service. IME Remit is here to help!!

Source : The World Bank